Theatrical 📽️ window 🪟 out of the window?

Why the current business model of the big film studios prohibits them from pivoting to Direct-to-Consumer (DTC) in the short term?

Happy Wednesday, everyone.

I recently wrote a piece about why Cineworld, the world’s second-largest movie theater chain, will struggle to change its fortunes in the short-term (mildly put). Your fantastic feedback encouraged me to look at the upstream industry, namely the business of movie studios like Warner Bros., Universal, and 20th Century Fox. What does postponement of virtually all blockbusters into 2021-2022 mean for them? And why don’t they all do what seems so obvious for us, consumers - namely offer their movies via streaming for $20-$30 instead?

October brings more bad news to cinema fans.

The buck didn’t stop with Cineworld. AMC, the number one theater chain in the world, said their attendance dropped 85% since reopening theaters in August and warned they’re running out of cash. Bankruptcy is on the table. AMC’s issues are the same as Cineworld’s - namely, sitting on a massive debt pile of 7.08x EBITDA that can’t be serviced through collapsed revenues anymore. Cinemark, the third-largest chain, is less leveraged than its rivals and more internationally diversified, with > 20% of its revenues earned outside of the US. Still, all three face the same structural issues I analyzed in detail when writing about Cineworld.

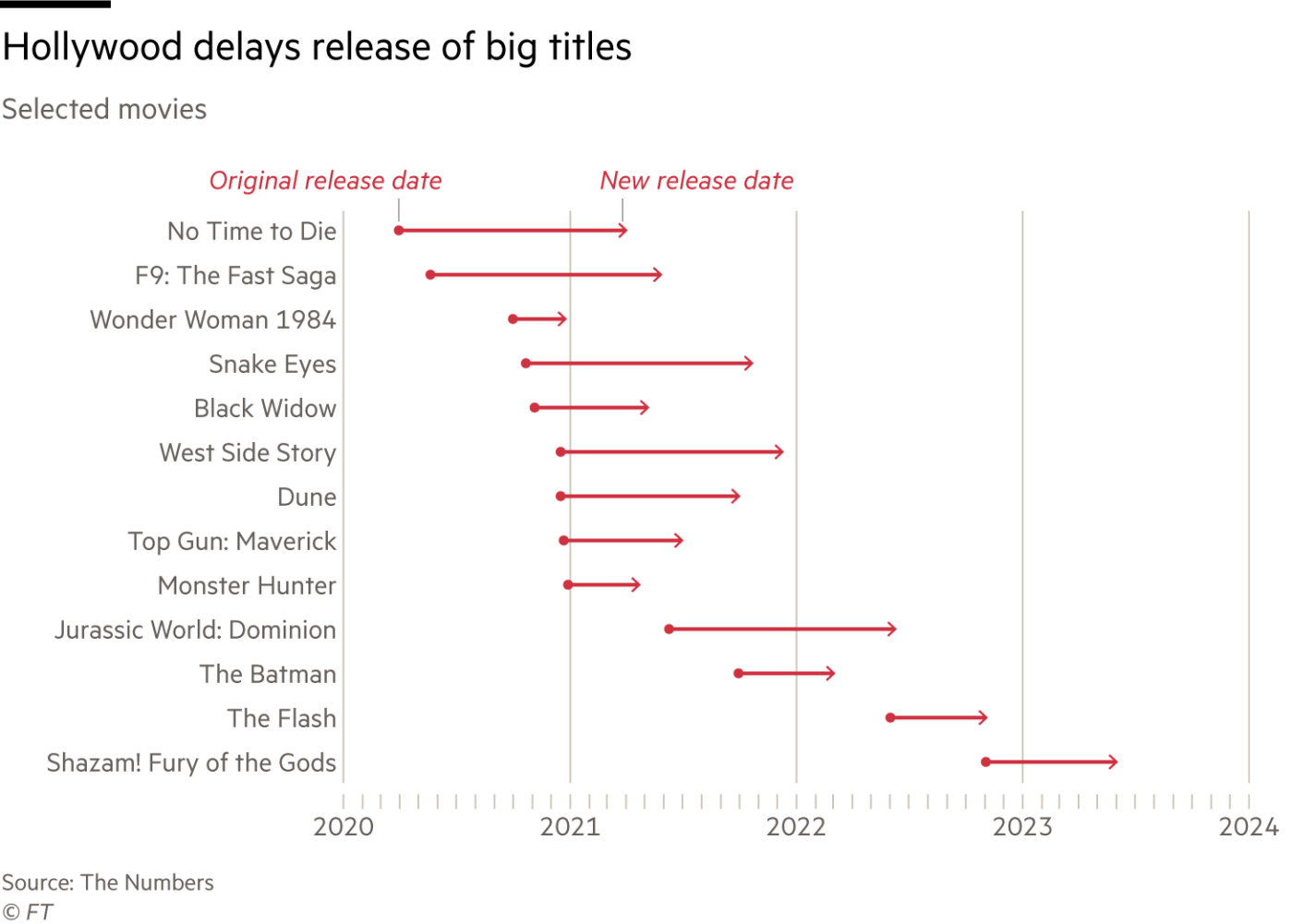

And there’s no light at the end of the tunnel in sight. The list of delayed blockbusters looks like a Gantt chart of a crappy 💩 project manager - everything shifted right:

Source: FT

Why delay instead of streaming?

A question all of us, outsiders to movie studio business, are asking is - why delay? People still watch lots of movies at home, right? And they’re probably ready to pay extra to stream a blockbuster from the comfort of their Covid-sheltered couch?

Isn’t that what movie studios started doing anyhow? Trolls World Tour skipped theaters back in April and was released straight onto streaming platforms. Then, Disney did the same with Mulan, launching it on Disney+ for a whopping $30, before making it available on Amazon Prime Video and Vudu for the same price a couple of days later.

Source: Disney

Yet other blockbusters didn’t follow suit. Warner Bros, Universal, MGM, and others are not pulling the plug on cinemas just yet. Even though Universal did shorten its exclusive theatrical window for AMC from 90 days down to 17.

But why aren’t studios bypassing the theaters altogether? Is it industry loyalty to its cinema partners (joke - what loyalty)? Or are there some fundamentals in play that prohibit studios from adopting a streaming-first business model?

How studios make their money on blockbusters today

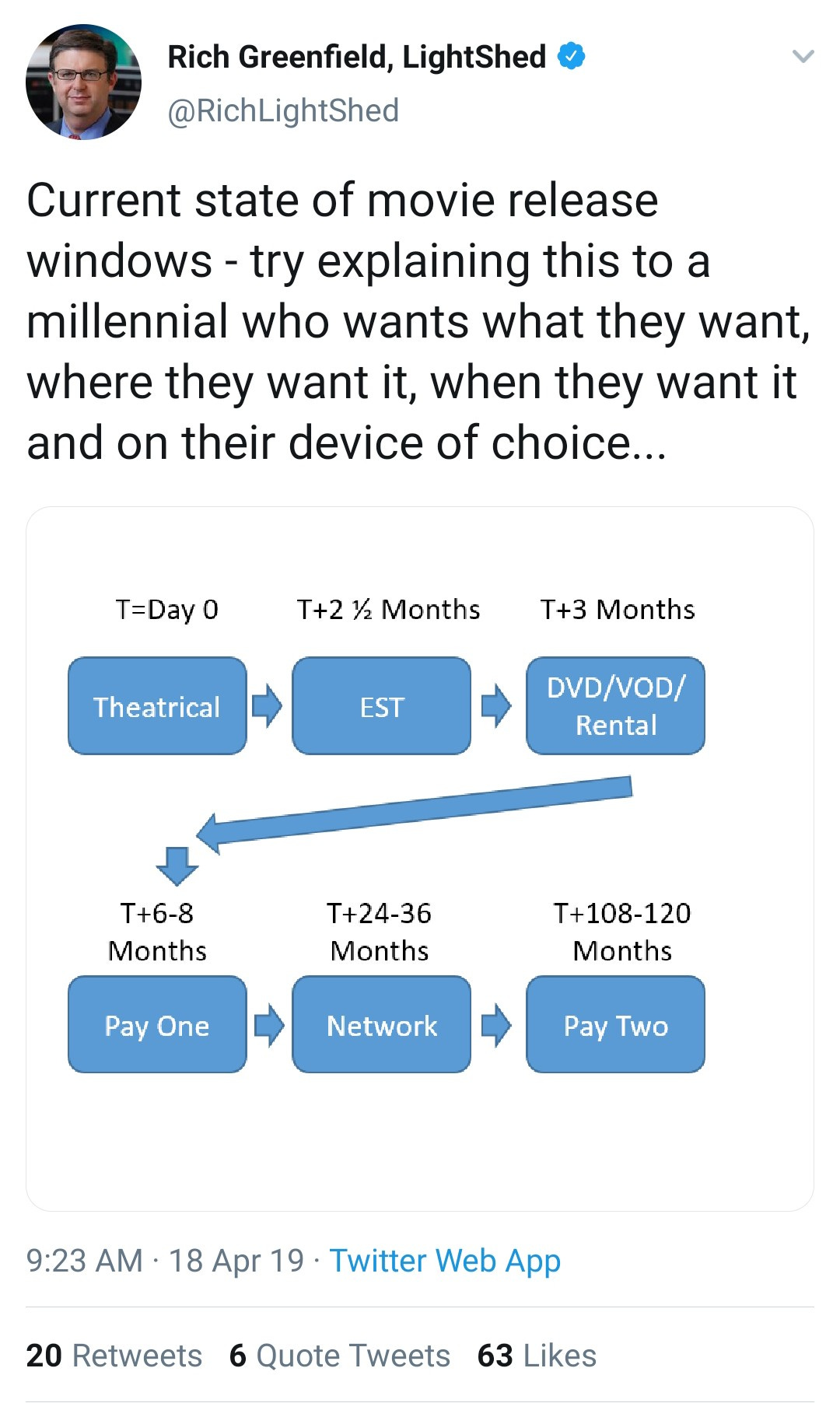

The entire business model of a film studio hinges on the so-called theatrical window:

A studio releases a movie exclusively in cinemas first.

From there on, a blockbuster goes to Electronic Sell-Through (EST) - iTunes, Amazon Prime Video, Hulu.

Afterward, a movie is available on VOD or DVD (yes, apparently, some people still buy DVDs 📀).

Pay One - this is when a movie becomes available on HBO, Showtime, Netflix some 6-8 months after premiering at the theater.

Network - your grandma watches a movie on TV 2-3 years after you’ve seen it at the cinema with friends.

Pay Two - when a 2015 movie suddenly shows up in the “Newly released” section on Netflix.

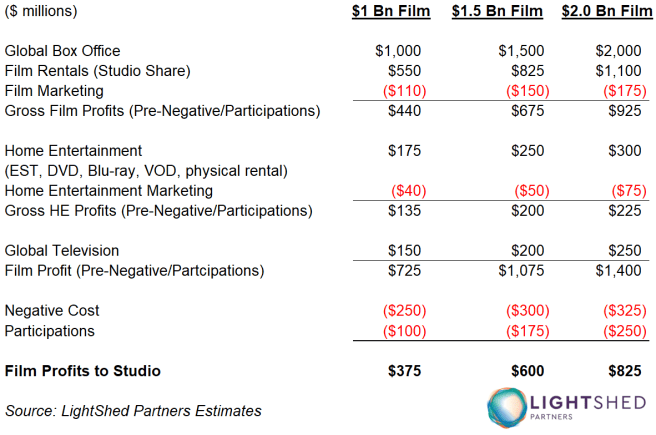

Of all the six windows, the theatrical 📽️🪟 one is THE money-making opportunity for a movie studio. LightShed Partners did a cool analysis on average revenues and profits for a hypothetical $1bn, $1.5bn, and $2bn global box office blockbuster:

Source: LightShed Partners

As you can see, a $1bn blockbuster will make 60% of its gross profit from the theatrical window alone (gross profit here means before negative cost, i.e., movie budget, and participations, i.e., % of profits paid to directors, writers, and top movie stars). The more expensive the movie, the higher the proportion of gross profit from the theatrical window becomes. It is 63% for a $1.5bn blockbuster, and 66% for a $2bn one.

The above numbers already hint at how much money a movie studio would have to make in streaming gross profits to compensate for the loss of the money-making theatrical window. $440m on a $1bn box office movie.

But is it doable? Let’s take a hypothetical example of James Bond’s “No Time To Die” saga - the latest premiere pushed out into 2021 due to Covid.

How many “No Time To Die” streaming passes would MGM need to sell?

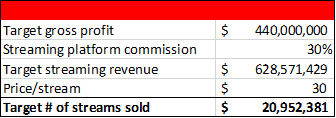

MGM earned a total of $2bn box office revenue for two latest James Bond movies - “Spectre” and “Skyfall” - approx. $1bn each. Let’s assume “No Time To Die” equally is a $1bn box office blockbuster. So, MGM would need to make $440m gross profit from streaming to replace theater profits.

At 30% streaming platform commission, MGM would have to make $629m in revenue from streaming passes. And with a movie priced at $30 (same as Mulan on Disney+), this means approx. 21 million(!) streaming passes sold:

Today, Netflix has 195m paid subscribers. So if MGM partnered with Netflix - it would have to sell “No Time To Die” stream pass to 11% of Netflix’s total base.

Can you get 21m paid viewers? It has been estimated that 9m people bought Mulan on Disney+, which is 29% of Disney+’ total of 30m viewers. So, the hypothetical case of MGM releasing its latest James Bond saga on Netflix, and making enough money to replace movie theater revenue stream, is not so far-fetched.

Will this logic hold if EVERYONE tries to sell movies Direct-to-Consumer (DTC) at $30 apiece?

The problem with this logic is that “Big Six” US movie studios release 3-4 blockbusters each per year - so, two blockbusters a month, on average. Whether consumers are ready to fork out $60 every month to pay for those remains to be seen.

And the studios won’t be just competing against each other there. They are up against thousands of movies and series their prospective customers already have access to on that same platform. Do I want to spend $30 on a new film, or do I watch an older one instead? Or, maybe, binge yet another true-crime documentary?

“There is no way to replicate those individual film economics through any other method of distribution [than a 6-window method described above]. While studios are experimenting with larger and larger films into PVOD [Premium Video On Demand, i.e. what I call a $30 streaming pass] , no studio is willing to release their biggest, most ambitious films this way”.

Where do we go from here?

Studios can’t bypass the theatrical window fully today because their business model of making high margins on a small number of expensive blockbusters is predicated on it.

Movie studio executives are betting on the world arriving at some “new normal” where people return to the movie theaters in 2021 to watch top hits. They prefer this to the prospect of losing money, trying to compete with Netflix, on Netflix’s turf.

Disney with its own Disney+ platform and Warner with its HBO Max are the favorites in the game of pivot to streaming - others don’t (yet) have the platform to do so. Disney warrants a separate deep-dive, especially considering their latest organizational changes, aimed at capturing benefits of platform + content model.

But, even Disney and Warner will need to work with the new economics of “streaming first.” This shift will require them to produce a lot more original content, with a lower average cost per content piece. I.e., moving from making a few huge bets into the business of making a vast number of smaller ones.

Applying this new model to the already produced movies is cost-prohibitive. That’s why we won’t watch the “No Time To Die” cuddled up on our sofas.

And, to be honest, I think it’s for the best. I can’t wait to enter the cinema on April 02nd, 2021. Like James Bond would say - “I like to do certain things the old-fashioned way.”

Source: Screenrant.com

I hope you enjoyed this post - subscribe now to get a weekly Actionable Hub dose delivered into your inbox next time onwards.

Until then,

Dmytro